Knowledge Exchange

Luxury after COVID-19: New trends that will reshape the industry

The COVID-19 crisis has impacted the majority of industries. For the luxury industry, the pandemic has accelerated the changes by adapting the new trends the crisis has created. Here, HKU MBA meets with Ryan (Wonwoo) Jang, HKU MBA Class of 2019, who currently works as a Senior Project Manager in one of the prestigious luxury brands.

HKU MBA: Can you explain how the pandemic impacted the retail market in Hong Kong?

Ryan Jang: In terms of Hong Kong market, I have witnessed two major trends:

- Exit Plan vs. Rebalancing Strategy in Hong Kong

It is truly unfortunate to see, but there have been multiple brands that have had to close down their flagship stores: Victoria’s Secret’s flagship store in Causeway Bay, which was the symbol of Hong Kong retail, GAP and Topshop made their move to leave Hong Kong. SaSa and Mannings, a complex personal care chain, have also gradually reduced their number of stores in Hong Kong.

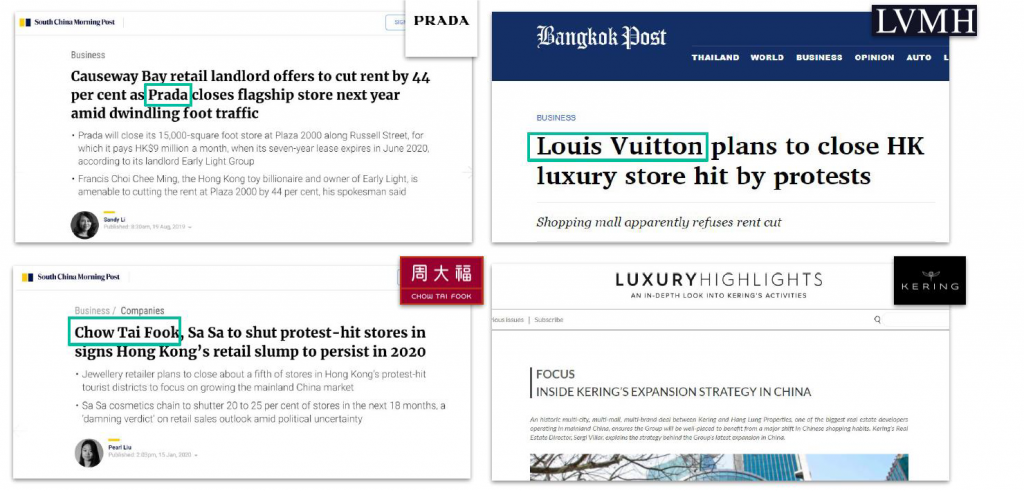

Particularly in the luxury industry, a number of brands shut down on Russell Street, one of the city’s premier luxury shopping destinations in Hong Kong. In fact, this trend has been gradually progressing in retail since 2019, a change which has been accelerated by the major decisions made by brands in the first quarter of 2020. With a reduced number of stores in Hong Kong, companies are now looking into new opportunities in Mainland China and the Great Bay Area(Macau and Shenzhen) as an alternative destinations.

- Protests, COVID-19 Crisis & Store Rental Fee

The retail industry has been slowly hit by the Hong Kong protests since the end of 2019. As the protests intensified at the end of 2019 and early 2020, stores had to reduce the operation time, or sometimes close for the entire weekend due to safety reasons. As the traffic of domestic/international customers decreased due to the protests, consequently, sales were hurt, and COVID-19 came around when the customer traffic started to recover from protests.

Hong Kong is having a very difficult time due to COVID-19. Given that there are ‘zero’ international customers, especially from Mainland China due to border closures, many retail businesses have once again realised how heavily the Hong Kong retail industry depends on overseas visitors. It is an essential aspect of the industry, therefore, retail companies are now looking at the Hong Kong market from a new perspective and are already planning their future strategies.

In Hong Kong retail, real estate rental fee is a very important part of decision making. In the case of the Causeway Bay Victoria Secret flagship store, as described above, the monthly rental fee was HKD 7 million. From a management standpoint, they could not simply wait for overseas travelers, and therefore were faced with an unpromising outlook.

The biggest concern for retail companies in Hong Kong right now is whether the city will be able to return to the “good old days” in the future.

HKU MBA: Let’s talk about the luxury market. What does the ‘new normal’ look like for the luxury industry, both during and after COVID-19?

Ryan Jang: Regardless of the crisis, Asia has been leading in sales. China is on track to become the biggest luxury market, as wealthy Chinese consumers travel less and splurge more in their home territory. Considering one of the global luxury groups’ 2020 fiscal year results, sales in Europe and the US contracted 30-40%, while Asia was down 4% compared with the fiscal year, thanks to a major contribution from China, followed by Korea within the Asia Pacific region. At this level it might be viewed that the region was hardly hit by COVID-19. It is amazing to mark a double-digit growth in Q2 under this market circumstance. There are three main reasons behind this, from my understanding.

First, since China’s post-COVID-19 recovery began in March 2020, a huge double-digit growth has continued steadily in the local luxury market. It could be possibly explained by stress-relief consumption from home confinement and no travel. Second, due to the government’s policy supporting and developing travel retail in the Sanya area in Hainan, mainland China, Chinese customers were able to consume domestically with tax benefits, rather than waiting for the border to be opened to the EU or US.

Also, there is a rapid change in the distribution channel. Sales through retail or wholesale channels, especially in Europe and the United States which lost Chinese tourists, suffered a big loss, whilst there was an accelerated shift to digital shopping. For the Chinese market, almost all luxury brands are already focusing their attention on e-commerce. For example, it is common to see a new-ecommerce platform embedded in Jingdong or Tmall, or launching its own brand’s e-commerce platform. E-commerce has already become one of the essential omni-channels of the luxury industry.

Different brands have different strategies to mitigate today’s threat and accelerate recovery. Some of the brands have established a Chinese e-commerce site solely, whilst others have tried investments or acquisitions in the form of a Joint Venture (JV) on a local platform that has already established a firm footprint in the Chinese retail industry. It is a totally ‘new normal’ for the luxury industry. Just a few years ago, I recall many big brand owners saying, “we’ll never sell luxury goods on the Internet.”

HKU MBA: What is your outlook for the luxury industry on post-COVID-19 and what would be the future strategy?

Ryan Jang: The COVID-19 crisis has not only resulted in a financial impact, but also profoundly changed its foundation and redefinition of ‘new normality’. Asia, especially China, has significantly offset the losses incurred in the European and US markets in 2020. From a management point of view, it is no longer working by passively waiting for the release of lock-down in Europe and the United States (or Hong Kong), for Chinese tourists to come and spend. The industry must transform and adopt the changes. I’d like to highlight some potential short and mid-term strategies:

- Develop a business plan on a short-term basis by reducing offline stores with sluggish sales and opening new, innovative stores in a fast recovery market.

- Rapidly shift the proportion of inventory to a growing market or specific cities and special economic zones.

- Focus on localisation and digitalisation strategy for e-commerce platforms, based on consumer behaviour, targeting consumers who have already adopted the new shopping behaviour during the pandemic.

- Rebalance human capital/resources to maximize the capacity in organisations during and after the pandemic.

I predict that another big change in retail will be around early-mid 2021, when the vaccine is possibly commercialised. However, even if the aviation industry resumes, for the time being, demand from Asian tourists will recover first within nearby regions (Korea/Japan/Taiwan/Hong Kong) rather than long distances, which means that China’s surged consumer power will be slightly distributed by other countries. Another important point here is that the consumption habits of luxury consumers who have already adapted considerably into e-commerce, which grew rapidly during the COVID-19 period, will continue to do so in the future.

Industry: Luxury Retail

Company: Richemont

Job Title: Senior Project Manager